|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Mortgage Rates Today in Texas: An In-depth GuideCurrent Trends in Texas Mortgage RatesAs of today, mortgage rates in Texas are influenced by a variety of economic factors. These include the Federal Reserve's monetary policy, inflation rates, and the state's housing market dynamics. Understanding these elements can help potential homeowners make informed decisions. Factors Affecting Mortgage Rates

Comparing Fixed and Adjustable-Rate MortgagesWhen considering a mortgage in Texas, understanding the difference between fixed and adjustable-rate mortgages is crucial. Fixed-rate mortgages offer stability with a constant interest rate, while adjustable-rate mortgages might start lower but can fluctuate over time. Pros and Cons

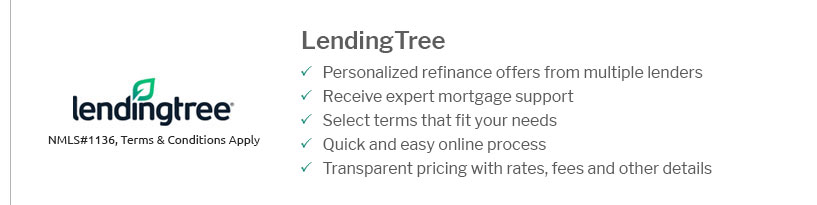

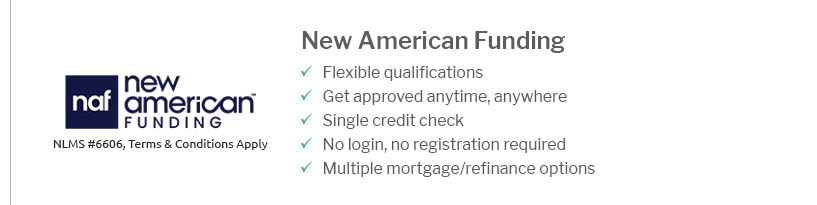

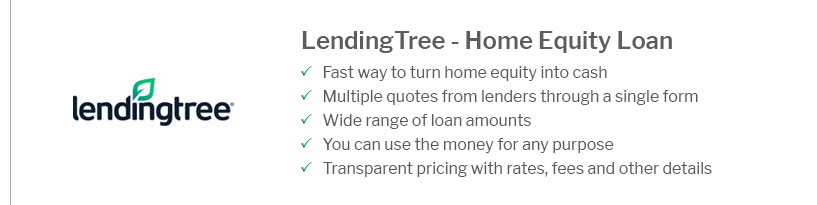

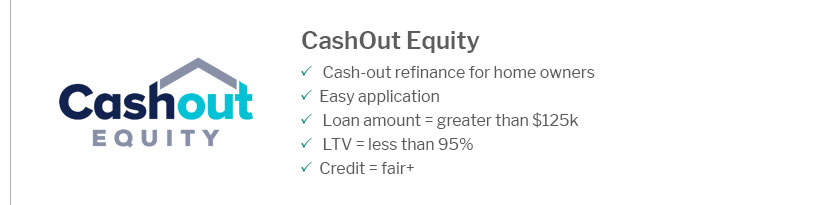

Refinancing Options in TexasFor those looking to lower their current mortgage payments or change their loan terms, refinancing is a viable option. The how to refinance your house loan guide offers detailed insights into the process. Additionally, programs such as the new home refinance program can provide tailored solutions for homeowners. Frequently Asked QuestionsWhat is the average mortgage rate in Texas today?The average mortgage rate in Texas varies but typically ranges between 3% to 5%, depending on the type and term of the loan. How do I qualify for the best mortgage rates in Texas?To qualify for the best rates, maintain a high credit score, ensure a stable income, and aim for a significant down payment. Lenders assess these factors to determine your risk level. Are there any specific programs for first-time homebuyers in Texas?Yes, Texas offers several programs for first-time buyers, such as the My First Texas Home program, which provides down payment assistance and competitive interest rates. https://www.bankrate.com/mortgages/mortgage-rates/texas/

Homeownership rate, Q4 2023: 63.6%; Median down payment, June 2024: $23,125; Median home sales price, Q2 2024: $345,000; Median days on market, Q2 2024: 54 ... https://www.nerdwallet.com/mortgages/mortgage-rates/texas

Today's mortgage rates in Texas are 6.937% for a 30-year fixed, 6.189% for a 15-year fixed, and 7.229% for a 5-year adjustable-rate mortgage (ARM) ... https://www.zillow.com/mortgage-rates/tx/

The current average 30-year fixed mortgage rate in Texas increased 3 basis points from 6.64% to 6.67%. Texas mortgage rates today are equal to the national ...

|

|---|